Tutorials:Uniswap Liquidity Pools II: Difference between revisions

Jump to navigation

Jump to search

m (1 revision imported) |

m (Move page script moved page Tutorials:C6b6 to Tutorials:Uniswap Liquidity Pools II) |

(No difference)

| |

Revision as of 01:41, 4 November 2025

Uniswap Liquidity Pools II

In the previous quest we reviewed the WMatic/Summer Liquidity Pool contract.

Let's compare it to the WEther/Summer Liquidity Pool:

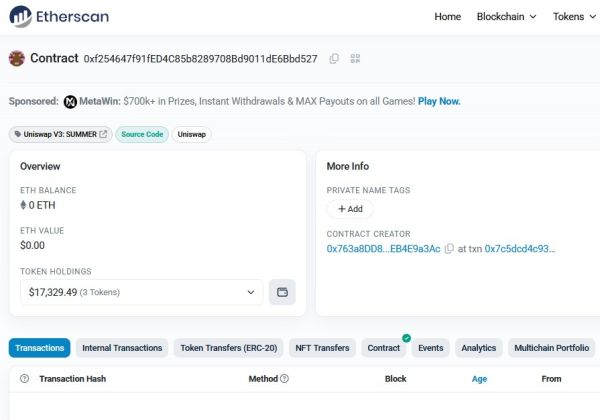

0xf254647f91fed4c85b8289708bd9011de6bbd527

Notice:

- In Tokens Holdings we see that there are only 3 assets. Because in Ethereum it is expensive to send transactions and spamming around is not cost effective.

- The total value of Ether and Tokens is significantly larger than the Polygon mining pool.

The fact that the total value of token holdings in Polygon is smaller than the Ethereum contract means that price impact is also a lot higher in Polygon than in Ethereum.

However transactions in Ethereum are more expensive, so you loose less on Price Impact, but pay more for gas.

Task:

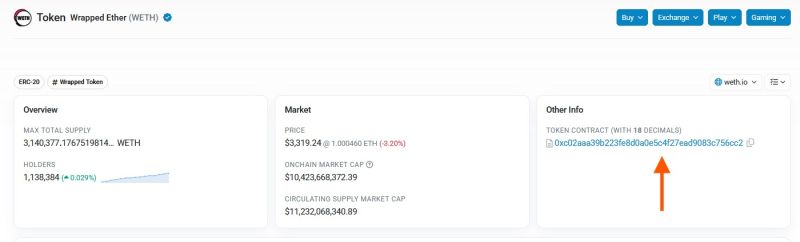

Find the Wrapped Ether contract address.

- Visit the WEther/Summer contract.

- In Token Holdings find the Wrapped Ether contract.

- Visit the Wrapped Ether page and copy the address.