Mining Supply: Difference between revisions

No edit summary |

|||

| (23 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

Seasonal Tokens Mining Supply is the hearth of the project. Scheduled halvings in the number of tokens per reward are the main driving force causing the relative price oscillations. | |||

You can check out the mining statistics in the website's [https://seasonaltokens.org/mining Mining Page] | |||

[[File: | [[File:Mining2025.png|800px]] | ||

When the mining supply gets cut in half you will see it in the mining page: | |||

[[File:Tokensperrewardsep2024.png |500px]] | |||

=Mining Pool Statistics= | |||

The mining page shows how many tokens have been mined so far, the token proportions, the mining difficulty in Tera Hashes per second, the Seasonal Tokens Mining Pool hashrate, the total hashrate and the number of tokens per reward. On average, every ten minutes a miner finds a reward. | |||

The | The total hashrate takes into account mining done outside the Seasonal Tokens mining pool, showing that there are people somewhere mining the tokens. | ||

=What do We Expect After the Halving?= | |||

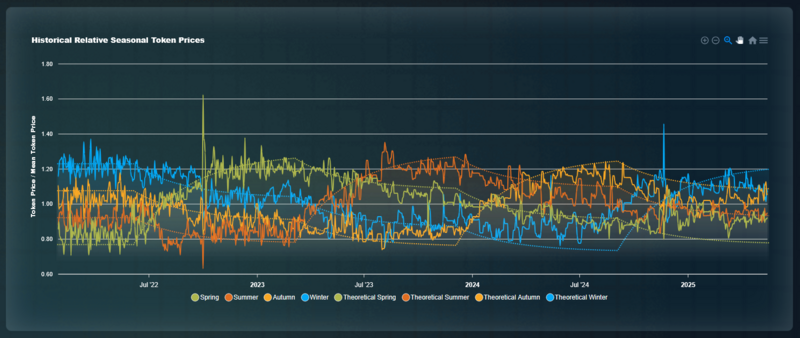

Over four years of data show that shortly after the halving of mining supply, the fastest token to produce starts to rise in price relative to the other 3 tokens: | |||

[[File:HistoricalRelPrice.png | | [[File:HistoricalRelPrice.png |800px]] | ||

=Number of Tokens per Reward= | =Number of Tokens per Reward= | ||

| Line 40: | Line 34: | ||

| September || 2021 || 168 || 140 || 120 || 105 | | September || 2021 || 168 || 140 || 120 || 105 | ||

|- | |- | ||

| June || 2022 || 84 || 140 || 120 || 105 | | June 5|| 2022 || 84 || 140 || 120 || 105 | ||

|- | |||

| March 5|| 2023 || 84 || 70 || 120 || 105 | |||

|- | |||

| December 5|| 2023 || 84 || 70 || 60 || 105 | |||

|- | |||

| September 4|| 2024 || 84 || 70 || 60 || 52.5 | |||

|- | |||

| June 5|| 2025 || 42 || 70 || 60 || 52.5 | |||

|- | |- | ||

| March || | | March 5|| 2026 || 42 || 35 || 60 || 52.5 | ||

|- | |- | ||

| December || | | December 5|| 2026 || 42 || 35 || 30 || 52.5 | ||

|- | |- | ||

| September || | | September 4|| 2027 || 42 || 35 || 30 || 26.25 | ||

|- | |- | ||

| June || | | June 4|| 2028 || 21 || 35 || 30 || 26.25 | ||

|} | |} | ||

= | =Token Economics= | ||

Proof of work cryptocurrencies behave like commodities in the physical world. They have a real cost of production given by the energy required to produce them, equipment, maintenance, time, etc. | |||

Seasonal Tokens are parts of the Ethereum blockchain, those "data structures" can't be copied, duplicated, forged, or created at will. You have to solve the proof of work to create them. And once created they will stay there as long as the Ethereum blockchain exists. | |||

= | ==Theoretical Price== | ||

Every ten minutes on average a reward is produced, all rewards have the same cost of production (on average), but they have different numbers of tokens per reward. If we call "C" the cost of production per reward and "R" the number of tokens per reward, then the cost of production of tokens is: C/R This is what is called "theoretical price". It is the price tokens would have if only the cost of production is taken into account. | |||

Prices are the result of combining the supply and demand, and they may be very different from this theoretical values. | |||

The Relative Price Chart displays the relative prices as solid lines, and the theoretical relative prices as dashed lines. Plotting the relative prices has the advantage that it eliminates external factors and leaves only the differences coming from the differences in the number of tokens per reward. | |||

==Mining Time== | |||

Another useful way to visualize the token's value is to think about "mining time", since all rewards have the same cost of production (on average), and they are produced every 10 minutes (on average), | |||

then the tokens that take longer to produce are the most valuable in terms of energy. | |||

Mining time is directly related to how much energy is employed in the production of tokens. If we call "R" the number of tokens per reward, then the mining time is = 600 sec/R | |||

mining time is proportional to the theoretical price. Both numbers capture the cost of production in terms of energy. | |||

Theoretical prices involve the cost of production "C" , which depends on the equipment used, the cost of electricity and other factors. But mining time is a conceptually simpler way to think about the energy cost of producing the tokens. | |||

=How to Mine Seasonal Tokens?= | |||

Seasonal Tokens can be mined using graphic cards, and that is how they started of life in 2021. That gave them a high cost of production and that is the reason why the liquidity pools were initialized at such prices. Soon after that people found ways to mine the tokens using special dedicated machines, such as the "Black Miner" FPGA, which can produce tokens a lot faster (and cheaper). After those machines started mining, it became unprofitable to mine using graphics cards. But still it is possible. | |||

For the historical records, here is the guide to mine tokens with graphic cards: | |||

[https://seasonaltokens.org/static/assets/docs/Seasonal_How-To_Guide_V4.pdf How To Guides] | |||

[[ File:Blackminer 01.jpg|200px]] | |||

Hash Altcoin BlackMiner F1 | |||

Latest revision as of 22:03, 5 December 2025

Seasonal Tokens Mining Supply is the hearth of the project. Scheduled halvings in the number of tokens per reward are the main driving force causing the relative price oscillations. You can check out the mining statistics in the website's Mining Page

When the mining supply gets cut in half you will see it in the mining page:

Mining Pool Statistics

The mining page shows how many tokens have been mined so far, the token proportions, the mining difficulty in Tera Hashes per second, the Seasonal Tokens Mining Pool hashrate, the total hashrate and the number of tokens per reward. On average, every ten minutes a miner finds a reward.

The total hashrate takes into account mining done outside the Seasonal Tokens mining pool, showing that there are people somewhere mining the tokens.

What do We Expect After the Halving?

Over four years of data show that shortly after the halving of mining supply, the fastest token to produce starts to rise in price relative to the other 3 tokens:

Number of Tokens per Reward

Every ten minutes on average a miner finds a solution to the proof of work challenge and receives a reward in tokens. There are 144 rewards per day.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| September | 2021 | 168 | 140 | 120 | 105 |

| June 5 | 2022 | 84 | 140 | 120 | 105 |

| March 5 | 2023 | 84 | 70 | 120 | 105 |

| December 5 | 2023 | 84 | 70 | 60 | 105 |

| September 4 | 2024 | 84 | 70 | 60 | 52.5 |

| June 5 | 2025 | 42 | 70 | 60 | 52.5 |

| March 5 | 2026 | 42 | 35 | 60 | 52.5 |

| December 5 | 2026 | 42 | 35 | 30 | 52.5 |

| September 4 | 2027 | 42 | 35 | 30 | 26.25 |

| June 4 | 2028 | 21 | 35 | 30 | 26.25 |

Token Economics

Proof of work cryptocurrencies behave like commodities in the physical world. They have a real cost of production given by the energy required to produce them, equipment, maintenance, time, etc. Seasonal Tokens are parts of the Ethereum blockchain, those "data structures" can't be copied, duplicated, forged, or created at will. You have to solve the proof of work to create them. And once created they will stay there as long as the Ethereum blockchain exists.

Theoretical Price

Every ten minutes on average a reward is produced, all rewards have the same cost of production (on average), but they have different numbers of tokens per reward. If we call "C" the cost of production per reward and "R" the number of tokens per reward, then the cost of production of tokens is: C/R This is what is called "theoretical price". It is the price tokens would have if only the cost of production is taken into account.

Prices are the result of combining the supply and demand, and they may be very different from this theoretical values.

The Relative Price Chart displays the relative prices as solid lines, and the theoretical relative prices as dashed lines. Plotting the relative prices has the advantage that it eliminates external factors and leaves only the differences coming from the differences in the number of tokens per reward.

Mining Time

Another useful way to visualize the token's value is to think about "mining time", since all rewards have the same cost of production (on average), and they are produced every 10 minutes (on average), then the tokens that take longer to produce are the most valuable in terms of energy.

Mining time is directly related to how much energy is employed in the production of tokens. If we call "R" the number of tokens per reward, then the mining time is = 600 sec/R mining time is proportional to the theoretical price. Both numbers capture the cost of production in terms of energy.

Theoretical prices involve the cost of production "C" , which depends on the equipment used, the cost of electricity and other factors. But mining time is a conceptually simpler way to think about the energy cost of producing the tokens.

How to Mine Seasonal Tokens?

Seasonal Tokens can be mined using graphic cards, and that is how they started of life in 2021. That gave them a high cost of production and that is the reason why the liquidity pools were initialized at such prices. Soon after that people found ways to mine the tokens using special dedicated machines, such as the "Black Miner" FPGA, which can produce tokens a lot faster (and cheaper). After those machines started mining, it became unprofitable to mine using graphics cards. But still it is possible.

For the historical records, here is the guide to mine tokens with graphic cards:

Hash Altcoin BlackMiner F1