Tutorials:Decentralized Exchange DEX: Difference between revisions

m (1 revision imported) |

m (Move page script moved page Tutorials:Ad11 to Tutorials:Decentralized Exchange DEX) |

(No difference)

| |

Latest revision as of 01:41, 4 November 2025

Quest: Decentralized Exchange (DEX)

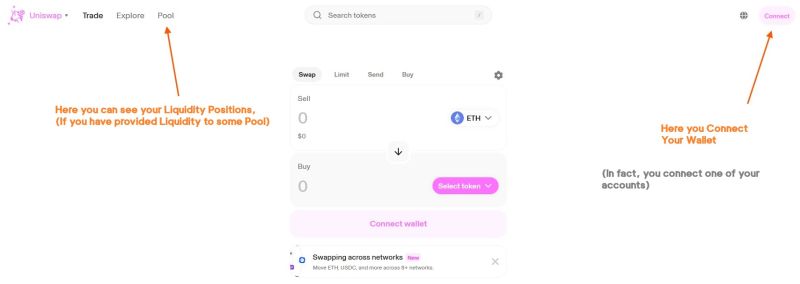

Decentralized exchanges (DEXs) represent a significant innovation in the cryptocurrency world, offering a way to trade assets without the need for a centralized authority. These platforms allow peer-to-peer trading directly from users' wallets, enhancing privacy and reducing the risk of theft from exchange breaches. One prominent example of a DEX is Uniswap V3, this is UniswapV3's: Swap Interface.

If you have your wallet connected, you select one asset in the "sell" field, and select the asset you want in the "buy" field, and click Swap.

Liquidity Pools

Liquidity Pools are used to implement a decentralized and automated way of trading digital assets (tokens).

In the Ethereum network Liquidity Pools are smart contracts holding a token and Ether, so that the number of tokens has the same dollar value as the number of Ether.

When a new token is added to the Decentralized Exchange, a new Liquidity Pool has to be created, by providing the Liquidity Pool contract with equal values of the token, and Ether.

For a liquidity pool in Polygon for example, you need equal values of tokens and POL, and so on.

Key Insight:

People providing liquidity to the decentralized markets earn some percent of the trades made.

This site shows Uniswap liquidity pools by Total Volume traded:

Notice that the largest pools are the ones that exchange "wrapped" Bitcoin and Ether, and the stable-coins USDC, USDT. Here we find two new concepts we haven't touched on yet: Wrapped assets and stable coins. We will come back to this in the Web III module.

The Ethereum blockchain can manage many digital assets, each governed by its own smart contract.

Other Decentralized Exchanges:

Here is a list of the Top Cryptocurrency Decentralized Exchanges:

Task

- In the CoinMarketCap page above, click on Uniswap V3 Ethereum.

- Find the year when Uniswap was launched.

Exercise

- In the What is Uniswap? information panel, note that Uniswap pioneered the Automated Market Maker (AMM) model.

- Unlike traditional order-book-based exchanges, AMMs use liquidity pools to facilitate trades.

Key Insight:

Understanding the AMM model is essential to grasp how decentralized markets operate. We will explain more this concept in the next quest. But first let's watch some videos to understand better these concepts.

Liquidity Pools Explained in Videos:

We have collected from YouTube some of the best videos explaining the concepts: